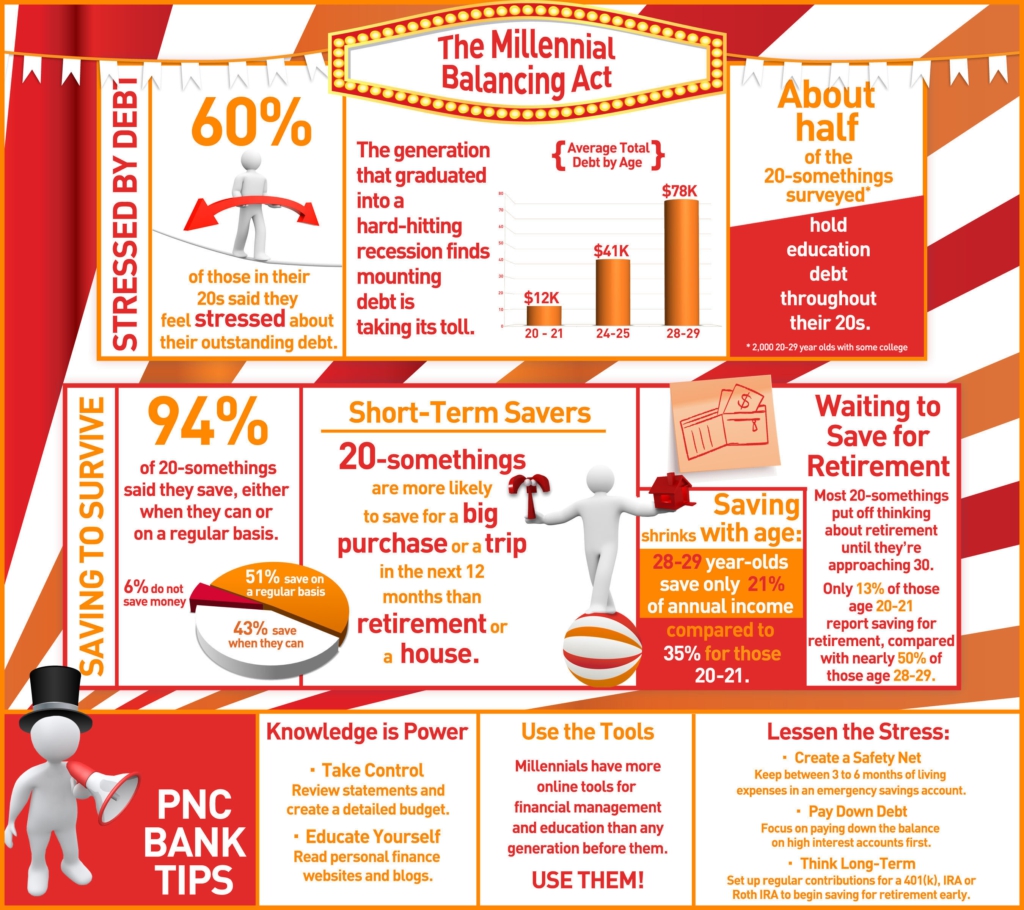

Twenty-somethings’ mounting debt is taking its toll, as 60 percent of the generation who grew up amid economic growth and graduated into a hard-hitting recession say they feel stressed about their outstanding debt, according to a survey by The PNC Financial Services Group, Inc. (NYSE: PNC).

Findings: Walking the Tightrope of Savings and Debt

Overwhelmed by debt:

- Debt Burden Increases with Age: On average, their total debt is $45,000, ranging from $12,000 for ages 20-21 to $78,000 for 28-29 year olds holding debt.

- Investing in Education: Over half of those surveyed hold education debt throughout their twenties. Education loans are the most frequently reported type of debt followed by credit card (ranging from 20-48 percent from age 20-29), car loans (9-38 percent) and mortgages (3-29 percent).

Saving to survive:

- Short-term Savers: 94 percent of those surveyed said that they save, either when they can or on a regular basis. Asked the reasons, more are saving for the short term than the long haul—53 percent are saving for a big purchase, 41 percent are saving for a trip in the next 12 months and only 36 percent and 38 percent are saving for a house and retirement, respectively.

- Saving for Retirement: Most 20-somethings put off thinking about funding retirement until they’re approaching 30. Only 13 percent of 20-21 year-olds report saving for retirement, compared with nearly 50 percent of 28-29 year-olds.

Tips: Establish a ‘Safety Net’ and Gain Control

PNC’s Johnson offers the following tips to help Generation Y navigate the balancing act of savings and debt and build the confidence to control their finances:

Knowledge is power.

Educate yourself on money management and financial planning. Visit your bank’s website and read personal finance news stories and blogs to better understand your financial situation and craft a detailed budget.

Use the tools.

Millennials have more tools for financial management and education, online and on their smartphones, than any generation before them. Use online and mobile tools, such as PNC Virtual Wallet®, to see all your accounts in one place, share advice, establish a budget and set up alerts to help with money management.

Debt evaluation.

Examine your debt and interest rates. Focus on paying down the balance on accounts with high interest rates first.

Create a Safety Net.

Try to keep between 3-6 months of living expenses in a ‘safety net’ savings account. This account can help you from falling further into debt should you have an unforeseen expense.

Think long-term.

Set up regular contributions for a 401(k). If you aren’t working or are not eligible for your employer’s retirement plan, set up an IRA or Roth IRA in order to begin saving for retirement early. Time is on your side to grow your nest egg.

*Information Source via PR Newswire and The PNC Financial Services Group, Inc. (www.pnc.com)

Image Source: (PRNewsFoto/PNC Financial Services Group, Inc.)