Elysabeth Teeko is in love with technology and interior decorating. She writes on various topics as it strikes her fancy. Follow her on Twitter- @elysateek

One of the main reasons that people don’t go back to school is Time.

What’s the other one? MONEY!

You can’t always make more of either of those in your life, but you can change the way you spend them so it seems as though you have more. If you want to have more money for school, you have to spend less in other areas. Even though this is common sense, it can also seem difficult. It’s really not hard at all – it just takes thought and discipline. In order to do it well, there are several things you can look at.

Where Can School Money Come From?

First, look realistically at how much you will be able to spend each semester on schooling. Then, look at ways to reduce that amount. The tuition isn’t going to change, but you might be able to reduce how much of it you have to pay with things like scholarships and grants.

Apply for any and all of them that you qualify for- you don’t have to be right out of high school to receive them, and you might actually be surprised at how many wacky/out of the normal grants exist out there.

There are some available for lower-income people, for moms going back to school, and for many other groups- apply for them. The worst that will happen is that you’ll be turned down and have to move to the next one. Be sure to apply in plenty of time for the semester you plan to start school- some grants and scholarships can take a while to be awarded.

You can also apply for loans, but be really super careful with these. Federal loans are the best choice for most people. Private loans can often cost you much more in the long run and often times you can’t get any kind of assistance when paying it back.

Doing your research is important.

Making More Room in the Budget

It’s very likely that you’ll still have to pay out some money for school each semester. In order to get that money, consider:

- Limiting or greatly reducing spending on things like movies or dinners out.

- Taking your coffee and lunch to work from home, instead of buying them out.

- Getting rid of either your land line or cell phone – you really don’t need both.

- Getting a smaller cable or satellite TV package. You’ll be busy studying, anyway.

- Reducing your electric bill by adjusting the thermostat by a couple of degrees.

- Shop with coupons and buy in bulk during big sales to lower the grocery bill.

There are many simple ways you can use in order to lower your costs. Make a budget for one month, and see how much you spend. Write down every cent, without changing any of your habits.

Are you surprised at the numbers?

Most people are, because they don’t realize just how much they’re handing over every month for bills, emergencies, and play time. Once you see what you’re spending every month, it becomes much easier to see ways you can reduce how much money’s getting paid out. Once you know these numbers, you’ll be able to save that money for your new school experience.

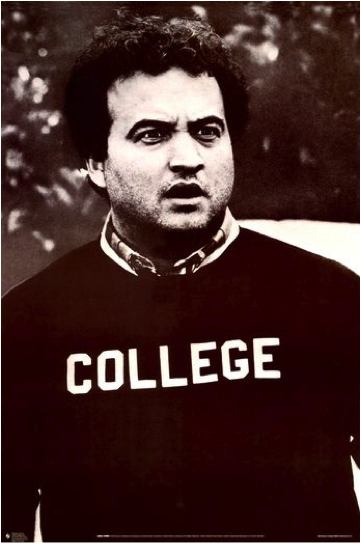

(Image: scienceblogs.com)